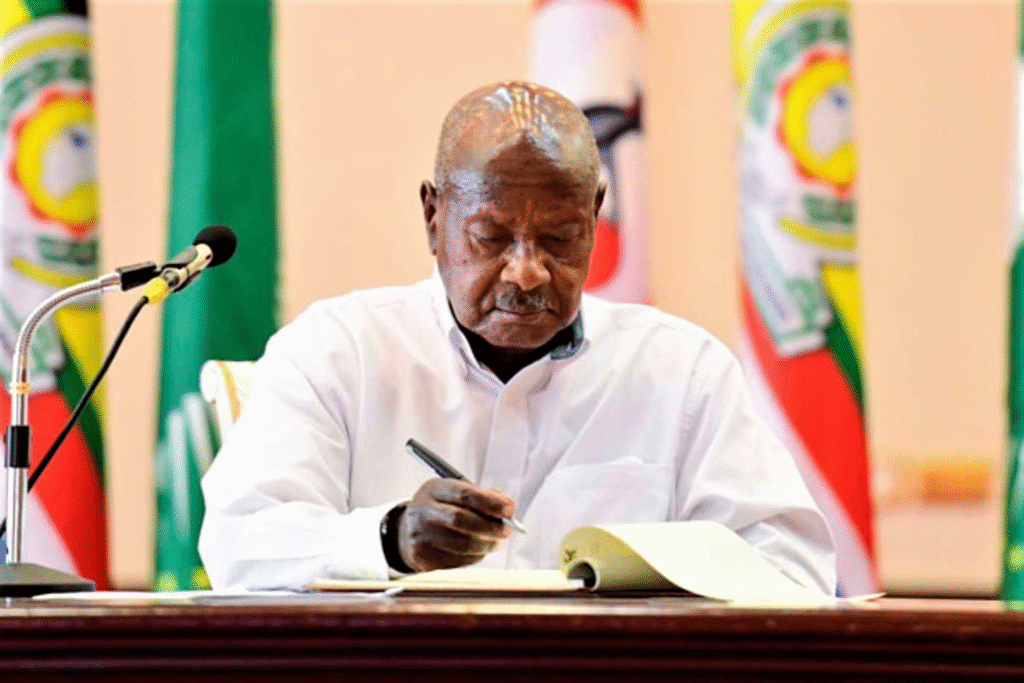

President Museveni Signs Seven Key Bills into Law

On June 30, 2025, President Yoweri Kaguta Museveni officially announced via social media that he had signed into law seven Bills recently passed by Parliament. Below is a summary of the new laws and their intended impact:

1. The Value Added Tax (Amendment) Act, 2025

This amendment to the VAT Act (Cap. 344) introduces an anti-fragmentation rule for imported goods and exempts biomass pellets and solar lanterns from VAT. It also sets a zero VAT rate for aircraft supplies and recognizes certain UN-related agencies as listed institutions. The law is expected to make renewable energy products like biomass pellets more affordable, thereby encouraging their use and supporting environmental conservation.

2. The Stamp Duty (Amendment) Act, 2025

This law amends Schedule 2 of the Stamp Duty Act (Cap. 339) by removing the UGX 15,000 tax on agreements and mortgage deeds. Passed by Parliament on May 25, 2025, the move is aimed at reducing the cost of formalizing contracts and promoting private sector growth by easing access to credit.

3. The Excise Duty (Amendment) (No. 2) Act, 2025

This amendment provides for tax refunds on damaged, expired, or obsolete goods and revises excise duty rates for certain goods and services listed under Schedule 2 of the Act.

4. The Tax Procedures Code (Amendment) Act, 2025

This law designates the National Identification Number (NIN) as the official Tax Identification Number (TIN) for individuals, streamlining tax registration and compliance.

5. The Supplementary Appropriation Act, 2025

This Act provides for additional government expenditure within the current financial year.

6. The Hides and Skins (Export Duty) (Amendment) Act, 2025

Passed on May 25, 2025, this amendment removes exemptions that had previously allowed untaxed exports of glue stock and semi-processed hides. Going forward, all such exports will be taxed at $0.80 (approx. UGX 2,800) per kilogram. The goal is to secure raw materials for local tanneries and support value addition within Uganda. The bill stirred debate over whether glue stock should be treated as a hide offcut or a food product (ponmo) for export to West Africa.

7. The External Trade (Amendment) Act, 2025

This law imposes a mandatory 1.5% infrastructure levy on all imported goods for domestic use. Previously, this levy applied only to selected items from outside the East African Community (EAC). The new provision, effective July 1, 2025, applies broadly to goods not exempted under the Fifth Schedule of the EACCMA, 2004. Exempt items include educational materials, emergency relief goods, agricultural inputs, refrigerated trucks, and equipment for persons with disabilities.

8. The Appropriation Act, 2025

This Act authorizes government spending of UGX 40.749 trillion from the Consolidated Fund for the 2025/2026 financial year to support national programs and services.

These legislative changes are aimed at stimulating economic growth, promoting renewable energy use, supporting local industries, improving tax administration, and ensuring better fiscal management.