President Museveni Urges Balanced Financing for Africa’s Transformation at Inaugural UDB Summit

President Yoweri Kaguta Museveni has reiterated the importance of development finance institutions (DFIs) in driving Africa’s transformation, calling on planners and financiers to strike a balance between infrastructure investment and projects that directly pull millions of people into the money economy.

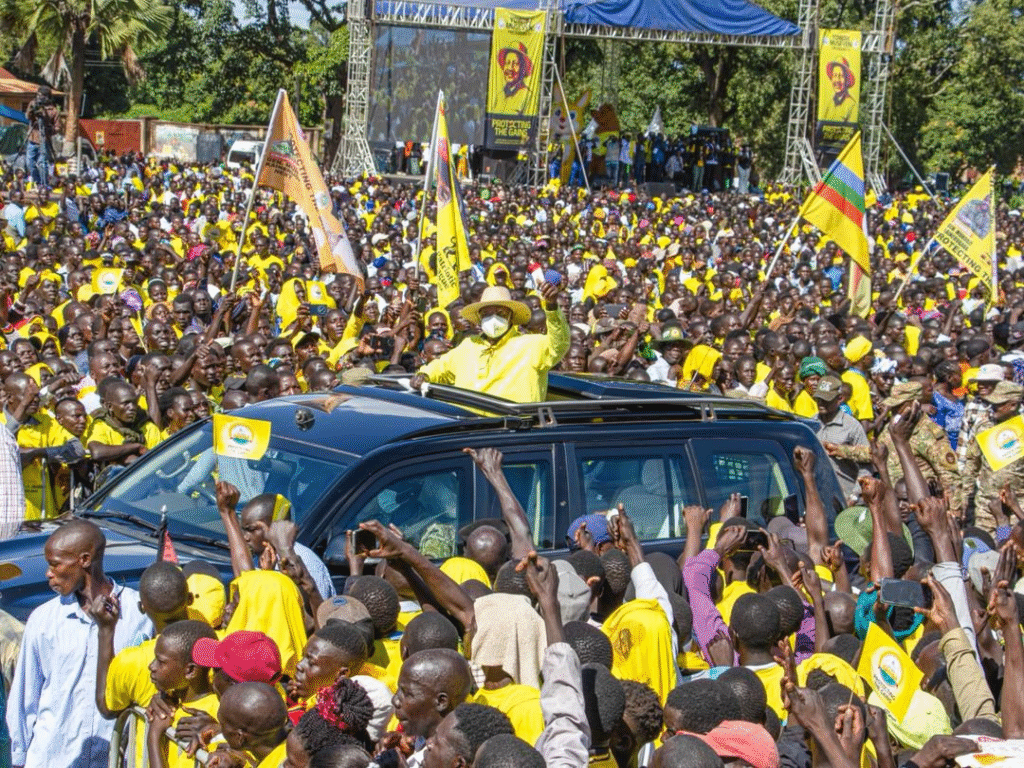

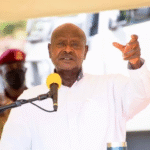

Speaking on Monday at the opening of the first-ever Uganda Development Finance Summit held at the Commonwealth Resort, Munyonyo, the President—accompanied by the First Lady and Minister of Education and Sports, Maama Janet Museveni—emphasised that while infrastructure is vital, it must go hand in hand with productivity-generating initiatives.

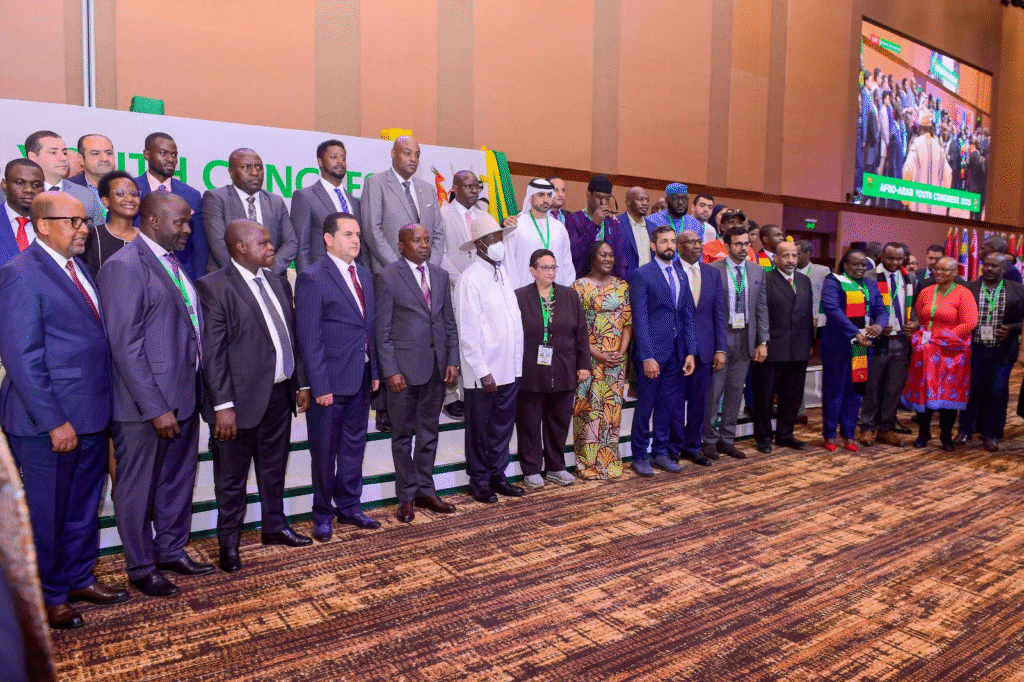

The two-day summit, hosted by the Uganda Development Bank (UDB), brought together government leaders, policymakers, financiers, the private sector, and international partners to explore how development finance can accelerate Africa’s socio-economic transformation.

Museveni, in a candid reflection on Uganda’s fiscal choices, pointed to the Parish Development Model (PDM) as an example of deliberately diverting funds towards enabling rural households to join the money economy. “You can have a good road, but it is meaningless if there’s nothing to transport on it,” he said, stressing the need to empower people to produce before focusing heavily on infrastructure.

He recalled Uganda’s post-independence priorities, faulting technocrats for investing heavily in social infrastructure such as schools and hospitals while neglecting the economic backbone—electricity, railways, and affordable transport systems. “A capitalist economy cannot function without cheap electricity and efficient transport. Yet all the cargo and fuel are still clogging our roads, instead of moving on railways and pipelines,” he observed, while thanking the EU for supporting the rehabilitation of the standard gauge railway.

Why UDB Matters

Tracing back to the 1960s, Museveni argued that Uganda needed a development bank because private savings were too limited, and foreign direct investment was not easily attracted. “That is why I pushed for UDB—a government institution that doesn’t chase profits but finances critical areas of wealth creation,” he said.

He underscored UDB’s role in financing the four productive sectors: commercial agriculture, manufacturing and artisanship, services like tourism and ICT. “Wealth is created in those four areas. Development benefits everyone, but wealth creation starts there. That’s why we needed UDB,” he added.

On Africa’s broader transformation, Museveni emphasised three essentials for industrial growth: cheap finance, electricity, and transport—backed by access to large markets. He argued that regional market integration is a “matter of life and death” for Africa, citing Latin America’s stagnation as a lesson in market fragmentation.

The President also challenged Africa to stop exporting raw materials cheaply, using coffee as an example: “A kilo of coffee sells at $2.5, but once processed into Nescafé, it goes for $40. That makes us donors without even knowing it.”

He further urged financiers to provide long-term “patient capital” for Africa’s development, citing Uganda’s hydropower projects built with Chinese financing. “With Karuma Dam, we produce power at 2.8 cents per kilowatt-hour. Once loans are cleared, it drops to 1.2 cents. That is real transformation,” he explained.

Vision and Integrity for Transformation

Museveni reminded policymakers that transformation requires vision and sacrifice. At independence, he said, Uganda’s economy was dominated by just six commodities (coffee, cotton, copper, tea, tobacco, and tourism), with only 9% of households in the money economy. “Leaders must diagnose problems like doctors and prescribe solutions,” he said.

He criticised commercial banks for lending at excessively high rates—around 22%—despite inflation being under 5%, calling them “engines of dependency” that stifle serious business. He reiterated that UDB offers a sustainable alternative by financing productive sectors with affordable credit.

Voices from the Summit

Finance Minister Matia Kasaija welcomed the summit as timely, noting that Africa is among the fastest-growing regions globally. Uganda, he said, grew at 6% in 2024 against the global average of 2.7%. He projected Uganda’s GDP—currently at nearly $50 billion—to hit $500 billion by 2040, driven by agro-industrialisation, mineral development, ICT, and tourism, with UDB as a key enabler.

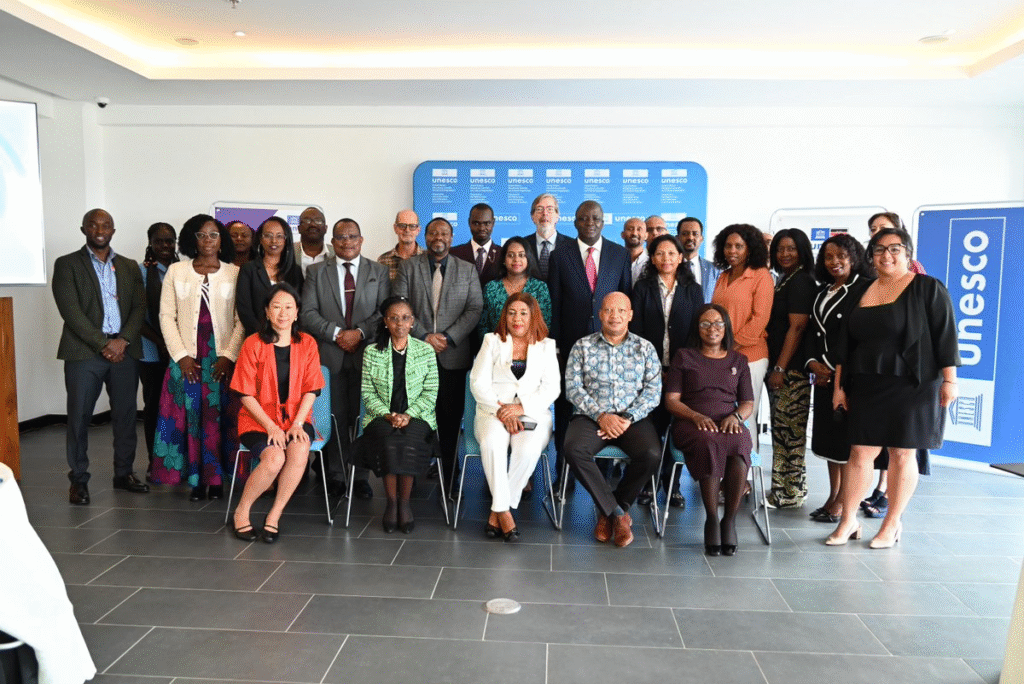

UDB Managing Director Dr. Patricia Ojangole emphasised that development banks play a pivotal role worldwide, citing Asia and Brazil as success stories. She noted that while commercial banks lend heavily to non-productive sectors like real estate, UDB channels over 80% of its financing into agriculture, manufacturing, energy, education, health, and water for production.

“With the realities of climate change, digital disruption, and limited fiscal space, development banks must innovate—through blended finance, digital infrastructure, and bankable project pipelines,” she said.

UDB Board Chairman Geoffrey T. Kihuguru also highlighted the urgency of creating jobs for Africa’s youthful population amid overlapping global crises, saying DFIs are uniquely positioned to expand financial inclusion and drive industrialisation.

The event was attended by ministers, MPs, diplomats, civil society representatives, and heads of DFIs and partner organisations.