Uganda Fights Illicit Alcohol with Digital Tax Stamps to Boost Revenue and Public Safety

In Uganda, an alarming 65% of all alcohol consumed is illicit—unregulated, untaxed, and often hazardous to health. This underground trade fuels addiction and disease while depriving the government of vital revenue needed for national development.

In response to this growing crisis, Uganda introduced the Digital Tax Stamps (DTS) system, also known as the Digital Tracking Solution. This innovation requires all manufacturers and importers of designated products, including alcohol, to apply digitally traceable tax stamps on their goods. The initiative aims to tackle illegal alcohol production while increasing government revenue.

Cracking Down with Technology

The DTS system is managed by SICPA Uganda, a global leader in authentication and traceability, in partnership with the Uganda Revenue Authority (URA) and the Ministry of Finance. Each excisable product is marked with a secure, tamper-proof digital stamp that allows for real-time monitoring, making it difficult for producers to evade taxes or operate illegally.

According to Isaac Arinaitwe, principal economist at the Ministry of Finance, the DTS program is transforming Uganda’s business environment by leveling the playing field. “DTS has dismantled the unfair advantage previously enjoyed by non-compliant businesses,” he noted. “It ensures tax fairness and boosts confidence in the market.”

Thanks to DTS, previously informal alcohol producers have been compelled to register, declare their production volumes, and enter the formal economy. This has already paid off—URA exceeded its mid-year revenue target for FY 2024/25 by UGX 322 billion.

Public Health Gains

Beyond revenue, the DTS system tackles a critical public health issue. Illicit alcohol, often brewed in unsafe conditions, poses serious risks—particularly in urban slums and rural communities. In cities like Kampala and Arua, 83% of surveyed drinkers admitted to consuming illicit alcohol within the past week, with youth among the most affected.

Contributing factors such as poverty, peer pressure, and weak parental oversight push young people toward cheap, dangerous brews. By enforcing compliance through digital stamps, Uganda is ensuring products meet safety standards and are subject to government oversight—reducing the circulation of harmful alcohol.

URA Commissioner General John Musinguzi reinforced the zero-tolerance stance, noting that even niche products like kombucha must comply with the regulations or risk shutdown. “This is a vital step toward eliminating untaxed, unsafe goods from the market,” he said.

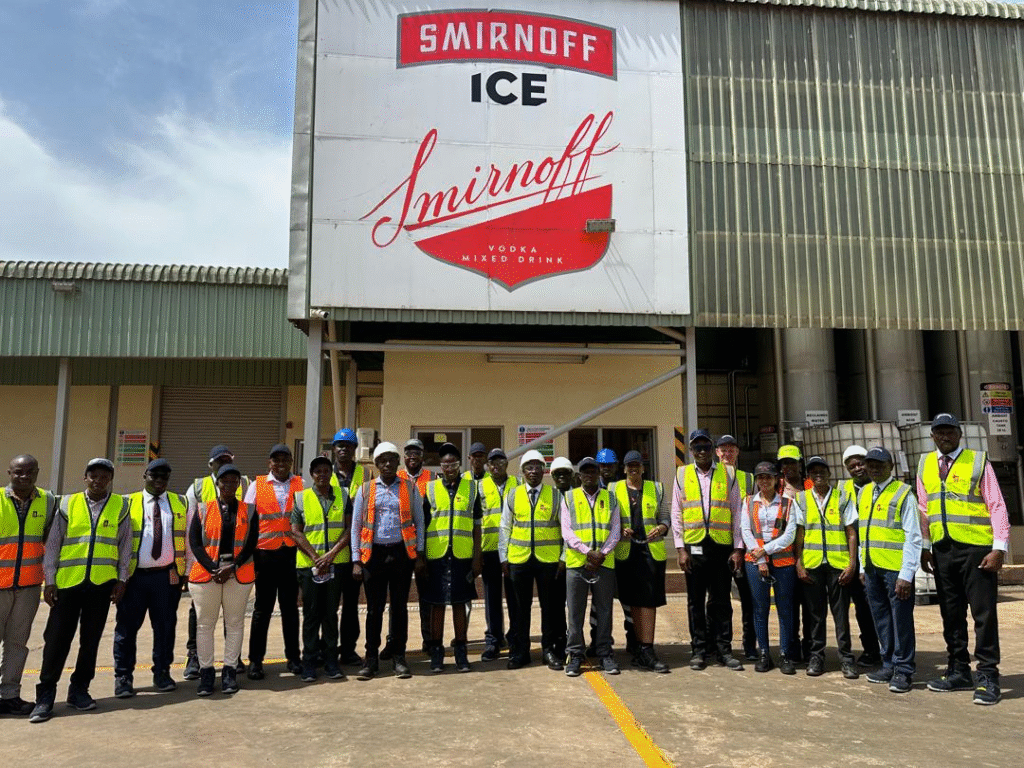

Business Compliance and Legal Framework

Manufacturers and importers of gazetted goods must register their facilities for excise duty as stipulated in Section 5 of the Excise Duty Act. They are also required to install DTS equipment on-site. Non-compliance comes with stiff penalties under Section 19B of the Tax Procedures Code Act, 2014—including a fine of UGX 50 million or double the tax owed, whichever is higher.

Strengthening Uganda’s Economy

Uganda’s tax-to-GDP ratio currently stands at 13.9%, significantly lower than the Sub-Saharan African average of 16%, according to ACODE. Despite ongoing efforts to improve domestic revenue collection, the country still faces challenges in meeting its budgetary needs.

The DTS initiative represents a forward-thinking solution to these challenges. It strengthens tax compliance, promotes public safety, and encourages formal business practices—all key to creating a more inclusive and resilient economy. Through technology and accountability, Uganda is setting a regional example in tackling illicit trade while driving national progress.