Government Launches Low-Interest ‘Katale Loan’ to Empower Kampala Market Vendors

Vendors operating in Kalerwe and St. Balikuddembe (Owino) markets are set to benefit from a new government initiative aimed at providing affordable business financing. Dubbed the Katale Loan, this program will offer loans at an annual interest rate of just 8% through the Microfinance Support Centre (MSC).

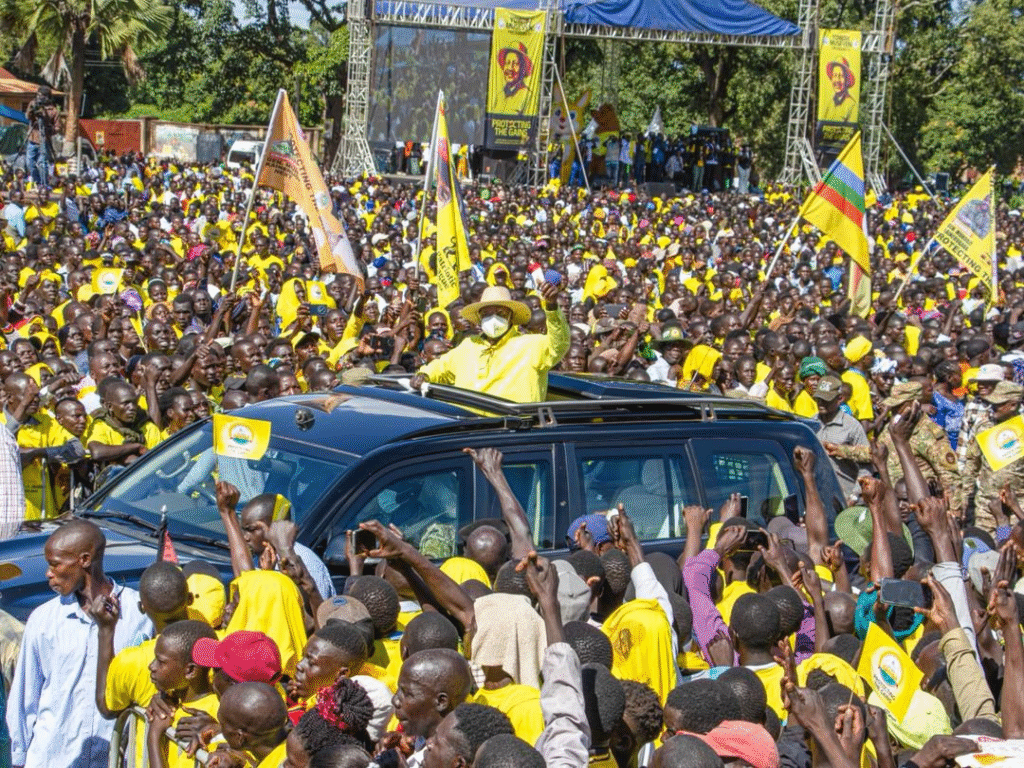

The initiative, a directive from President Yoweri Kaguta Museveni, specifically targets low-income traders and seeks to empower them economically. State House officials have confirmed that the Katale Loan is a pilot project that could be expanded to other markets in the central region, depending on its success in Kampala.

Over 10,000 vendors in 24 sub-markets in Kalerwe alone, as well as traders in Owino market, are expected to benefit.

Government’s Commitment to Protect Traders

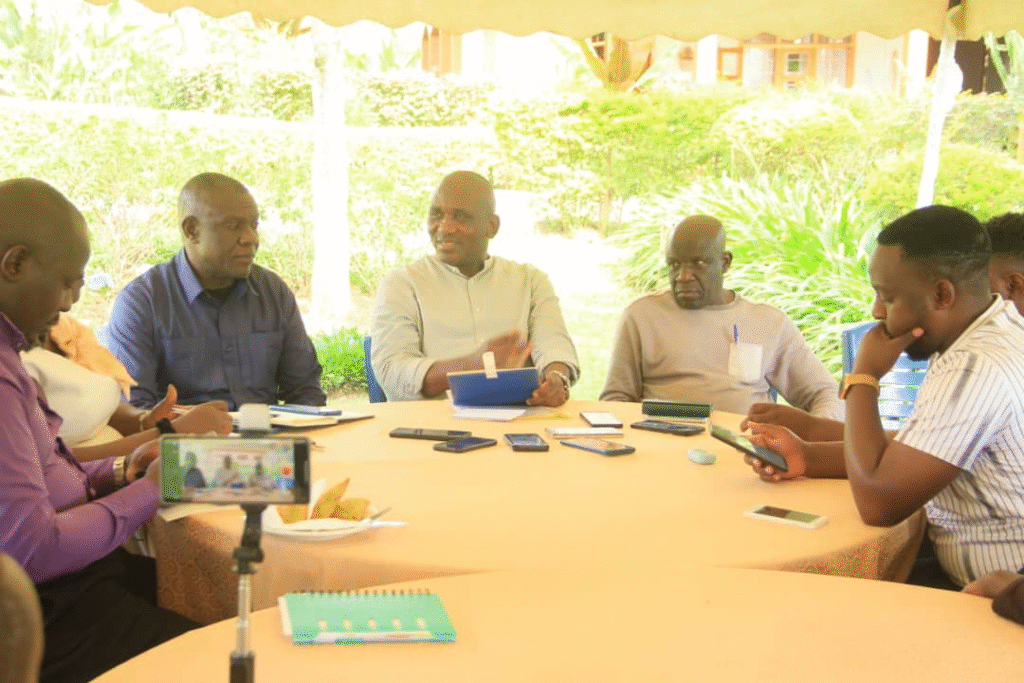

During a stakeholders’ meeting held on May 20, 2025, at Fairway Hotel, Senior Presidential Advisor for Political Mobilization, Mr. Moses Byaruhanga, assured vendors that the government launched the Katale Loan to protect them from exploitative moneylenders.

“We’ve received reports of moneylenders demanding National IDs as loan collateral, which is illegal,” Byaruhanga said. “This initiative is meant to offer you an easier, safer path to accessing capital.”

He urged vendors to form small groups of five to ten people to simplify loan verification and processing. The loans, which require no collateral, will be deposited directly to beneficiaries via mobile money after MSC verifies group endorsements.

Tackling Doubts, Building Trust

Mr. Byaruhanga also addressed the skepticism some vendors have shown towards government efforts to upgrade market infrastructure. He revealed that vendors in non-compliant markets continue to operate under poor conditions due to resistance to government improvement projects.

“Some vendors feared rent hikes or land acquisition issues if we upgraded their markets,” he explained. “So, only those who welcomed the changes received improvements.”

The meeting brought together over 200 participants, including women traders, market leaders, Local Council officials, and KCCA representatives.

Vendor Leaders Welcome the Initiative

Hajjat Madinah Nsereko from State House commended the mobilization team for organizing the meeting on short notice. Mr. Badru Lutalo, a market leader from Owino, shared structural concerns, noting the market has over 100 shelters, each with its own leadership. He appealed for government support in acquiring an official coordination office.

Vendors expressed optimism about the Katale Loan and agreed to keep politics out of the initiative. Mr. Dalawusi Kibuuka, Vice Chairperson of Ddembe Market (Kalerwe), pledged to raise awareness about the loan among fellow vendors. Ms. Winnie Nalwoga from Nyanja Zone (Owino) urged KCCA to simplify the loan process to avoid discouraging vendors and pushing them back to predatory lenders.

KCCA Responds

KCCA’s Deputy Director for Production and Marketing, Dr. David Musunga, acknowledged the issue of poor hygiene in public market toilets, citing space limitations, but pledged continued support.

Mr. Julius Kasirye, KCCA’s Manager of Commercial Services, lauded the entrepreneurial spirit of vendors in Kalerwe and Owino. “These are key markets in Kampala, which is why they were chosen to pilot this program. Its success here is critical for scaling up to other markets,” he noted.

How to Access the Katale Loan

MSC officials explained that the loan is available to Ugandan adults aged 18 to 75. Applicants must open bank accounts and submit a copy of their national ID along with their National Identification Number (NIN). No collateral is required—only an endorsement from a market representative.

Ms. Lotah Arimureeba, a Client Relationship Officer at MSC, emphasized the program’s focus on small business owners, roadside vendors, and low-income earners, especially women and single mothers.

“We understand the struggles vendors face when seeking financing. Through the government, MSC is stepping in to provide support aimed at real development,” she said. Arimureeba clarified that MSC operates independently of any political party.

Eligible vendors can expect to receive funds within two weeks of meeting all requirements.